As you might imagine, we see a lot of hockey stick financial models and fluffy sales pipelines in the course of evaluating potential investments. I was certainly guilty of producing some pretty optimistic projections myself during my time on the other side of the table (I still chuckle when I look back at some of our startup and early stage projections…they were very much reflective of the ‘dot-com bubble’). To be fair, if you are not optimistic, you are probably not going to make it as an entrepreneur. However, there is a difference between a real sales pipeline and some of the ‘pipe dreams’ we often see.

You can separate the wheat from the chafe in a pipeline by digging beneath the surface and looking for indicators of a ‘repeatable’ process. I often get questions from entrepreneurs on what indicators we look for, so I thought I would share some of the ways we evaluate this. One disclaimer – evaluating the sales processes of a B2B enterprise software company and a B2C e-commerce company (or other business type) are different exercises. For this post, I will focus on the sales process of a typical early growth stage B2B enterprise software company.

Certain revenue thresholds are sometimes viewed as a proxy for how repeatable a sales process is. This can be misleading. I’ve seen $1m revenue companies with more repeatable processes than $5m or $7m companies. Often, the larger companies have landed some big whale accounts by leveraging the founding team’s skill sets and networks. There is nothing wrong with founder-led sales and taking advantage of your own network. Most early stage companies live or die by this type of selling. But just because a company racks up several million dollars in sales this way doesn’t mean they have a repeatable process. The founders’ time is not infinitely scalable, nor is their rolodex of contacts.

So, how do we evaluate if a company has a repeatable sales process? We start with a review of the basics – pro forma models, historical financials, sales pipelines, current/prior staffing, and deal history:

- Pro forma models can be an initial indicator of how well a company understands its sales process. If the revenue growth in a model is hard coded or only loosely tied to any identified drivers, that’s a pretty good indicator of an immature sales process. Companies that have established a repeatable process typically understand the levers that increase sales and model their growth accordingly (see our post on forecast modeling). When we see these drivers in place in a model that’s a good sign, and our next step is to then dig into prior sales history to see if the data provides support for the assumptions.

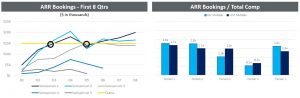

- Reviewing a break out of the P/L and customer growth by month along with staffing and deal history provides visibility into the build of sales over time, and leads to a next set of questions. Have sales been lumpy or episodic as the mgmt’s focus comes on or off selling? Does sales growth align with sales staff growth? Does the CEO still lead or get heavily involved in each sale? Has the company been able to hire sales staff and ramp individual sellers to sufficient quota within a reasonable time period? If so, how many sellers have they been able to ramp and sustain at these levels? What is the success/failure rate of new sellers? The following two charts provide illustrative examples of how we often visualize the data behind these questions. The chart on the left is helpful in assessing the track record of getting people to full quota in a consistent and timely manner (notice 2 of the 5 hypothetical salespeople never got there). The chart on the right provides useful insights into the economics of a given sales team. This helps in addressing questions around selling capacity and scalability. In SaaS businesses, we typically look for fully ramped salespeople to be generating ARR bookings of >3x their total comp.

- Reviewing the sales pipeline provides another level of visibility and prompts more questions:

- How has the business generated new sales leads? How many leads have been generated over the last quarter and over the last year? Are there indicators this lead gen process is sustainable, scalable, and in line with an acceptable overall CAC (cost to acquire a customer)? Mining the CEO’s rolodex is not scalable, but a well-structured digital marketing process that drives inbound leads or a disciplined outreach process with a sales development team often can be (more on that in a future post).

- Once leads are delivered to the sales team, is there a clearly defined pipeline process to bring a deal to closure that is based on an understanding of the buyer journey from prior deals? Is there enough of a mid and late stage funnel to support near term growth assumptions (this quantity will vary based on length of sales cycle…companies with 30 day cycles will likely have less in a funnel than those with 6 month+ cycles). Are deals moving through the funnel at a velocity that supports the future sales assumptions? How old are the deals in each stage? As we often see, stagnant deals can linger in a pipeline, over-inflating the potential yield.

- Are pipeline stages clearly defined by measurable actions taken by the customer? Stages are often defined by seller actions vs. buyer actions, and therefore a perception of progress may exist on the seller side, but that perception may be very different from reality on the buyer side. As an insightful sales leader at one of our companies noted to me recently, sellers often see what they want to see, and report progress accordingly. A well-structured process accounts for this, and doesn’t progress a deal through stages without definitive actions taken by the buyer (e.g. buyer acknowledging they are running a purchase process with a set timeline for final decision, buyer designating a vendor of choice, buyer requesting a contract) as opposed to seller actions (e.g. seller perceiving their contact’s willingness to schedule a demo or presentation as proof they are running a process, seller perceiving their buyer champion’s preference for our solution as proof that we have been selected as vendor of choice, or seller sending a contract proactively vs. the client requesting one and indicating a legal review has begun).

If you’re the entrepreneur and haven’t focused on these questions before, the diligence process with an institutional investor may feel like a distraction from the daily demands of running the business. No doubt parts of it are. After all, you’re educating an outsider on how your business operates. That said, the analysis outlined above is critical in understanding and improving a sales process. Whether or not you decide to pursue venture funding, I strongly recommend you carve out time to closely analyze this aspect of your business. If you are still early stage, keep your process simple, but define a clear set of steps, create a hypothesis for activity rates and conversion metrics in each step, and be disciplined in collecting metrics to assess reality vs. your hypothesis. I will try share a few more practical suggestions on this in a future post.