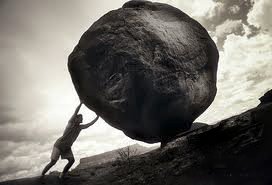

In the early stages of scaling a business, it’s perfectly natural to cheer for each new sale with the same enthusiasm as the last. After all, new deals drive growth. Not to mention they put cash in the bank. A strong focus on top-line growth is critical, but it can be all too easy to fall into the “growth at any cost” (aka GAC) trap.

A customer is not a customer is not a customer. There are profitable, net positive customers (accretive customers), there are unprofitable – but sometimes necessary – customers (dilutive customers), and then there are high cost, burdensome and generally no-good customers (deadweight customers). Distinguishing between the three is vital but often deceptively difficult.

We’ve put together a rough guide to gaining a “true” picture of a given customer base. This exercise, while somewhat time intensive, can be immensely powerful in guiding the continual refinement of your sales and marketing operations, your customer success teams and your general go-to-market strategy. Ultimately, all of this drives higher profitability and more efficient growth.

1) Get the inputs:

The first step is to pull together a clean, comprehensive schedule of subscription revenue (assuming it’s a SaaS business) by customer across a span of time (the past 24+ months on a monthly / quarterly basis is a good standard). This sounds simple enough, but as with many things, the devil is in the details. For example, you’ll want to roll up intra-customer accounts to the customer level and normalize any misrepresentative numbers (e.g., small bits of revenue recognition at beginning / end of a period). Once you’ve completed the revenue schedule, consider layering in additional customer information (e.g., channel, geographic region, product line, etc.). The more relevant information you bring into this master customer view the better.

2) Analyze the data:

Once you have your master customer view, run the numbers on your aggregate unit economics (CAC, churn, LTV, etc.). You might think you already have a firm handle on these metrics but sometimes this finetuned dataset reveals a slightly different view. Regardless, tying your metrics to this exact dataset will give you an aggregate benchmark with which to compare various customer segments in an apples-to-apples manner. If you’d like to brush up on these calculations, you can review our post on financial modeling.

3) Filter down to your problem customers:

Start scanning through the customers that have churned. Can you recognize any themes? How large are they? Where are they located? What products are they using? Through which channel were they sold? Start to hone in on a few distinguishing characteristics.

Next, reach out to the appropriate people in the sales and customer success teams. Obviously, there are a number of components to customer profitability beyond churn – churn just happens to be the easiest starting point for this when you have data with little context. Solicit color commentary to round out the picture. With the sales team, ask about the time and effort required to close these high-churn customers. With the customer success team, ask about the resources required to service these customers. These conversations are invaluable to gaining a fuller understanding of whether you are on the right track to identifying your “deadweight customers”. Synthesize this feedback and revise your deadweight customer profile as appropriate until, ideally, you’ve clearly defined the the group / groups with inferior metrics.

More often than not, you will be able to identify through this process a specific group of customers that either cost a lot more to acquire relative to revenue generated, require more ongoing assistance, churn more frequently, or all of the above. Along the way, you can also start separating dilutive but necessary customers from the purely deadweight, a fine line but an important one. For example, a customer may generate relatively little revenue and represent a heavy burden on your customer success team, but they may be a marquee logo and carry substantial weight in their particular industry vertical, a key market for your product. In this case, the customer may be slightly unprofitable on a net basis, but they may be necessary in the context of the broader scope of the business.

4) Confirm your accretive customers:

Identifying your accretive customer types is just as important as identifying the deadweight customer types. Follow a similar process to the step outlined directly above, but obviously hone in on the customers that have the most significant overall contribution with regard to LTV, CAC, churn, etc. (upsell is another piece to consider in this puzzle). You’ll likely find that these processes (filtering for the good and filtering for the bad) naturally run together.

5) Push learnings through the organization:

Armed with this important knowledge of your customer base that otherwise would’ve been buried in the aggregate metrics, you can guide the sales and marketing teams to avoid prospects with a particular profile, which is now well defined, and emphasize prospects with another profile. You can also adjust the customer success team and even the product team to better serve your accretive customers. Turning the learnings of this exercise into action is easier said than done, but strong execution on this will ensure that your organization is getting the most out of this exercise and, most importantly, optimizing the efficiency of its growth.

Recently, we helped a portfolio company through this exact exercise and it proved quite valuable. For this business, it turned out that a group of low dollar contracts all sharing a similar profile was lurking in the shadows, accounting for an outsized portion of the company’s churn. Upon digging further and having some conversations across the organization, we learned that this same sub-group was commandeering a substantial portion of the customer success team’s time. High churn, low dollar, and needy: we found the deadweight customers. Now, the company is making the appropriate adjustments throughout the organization.

In our experience, companies who take the time to periodically dive deep into customer composition, pair the quantitative with the qualitative, then maintain a strong feedback loop connecting pre-customer, current-customer and post-customer operations, are able to drive the most efficient growth.