What does a bonafide CFO bring to the table? Are they really worth the price tag? When should I hire one?

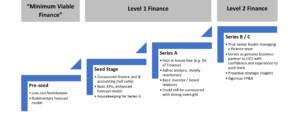

Questions like these have many founders scratching their heads. This confusion can cause startups to over-hire too early or wait too long on this critical hire, causing pain down the road. We typically offer founders the following framework as they consider their evolving financial needs:

_______________

The “When”:

At initial launch, you can satisfy most of your finance and accounting needs with an outsourced bookkeeper and a very basic cash forecasting model.

Level 1 Finance Function

As you advance through seed stage, you will likely want to upgrade to more of a full-suite outsourced finance and accounting service (e.g., TechCXO or other fractional providers). These services can help you improve your financial analysis, forecast modeling, and help get your house in order for a Series A fundraise.

Most startups can get by without a dedicated finance person through Series A, at which point it typically makes sense to hire someone in-house. The job to be done at this point is general financial process management (closing the books with accounting support, managing AR/AP, basic KPIs, budgeting, perhaps some light HR functions) and mostly reactionary analysis. Usually, it can be handled by a capable but less experienced person. For easy reference, let’s call this “Level 1” in-house finance.

Level 2 Finance Function

By the time you approach the Series B / C milestone, it’s usually time to hire a seasoned leader to build out a more sophisticated internal finance function. We will call this “Level 2” in-house finance. Level 2 finance should be led by a more experienced individual who can drive both the tactical and strategic functions within finance (more on this below) and perhaps lead or assist in other areas of your business (e.g., HR and/or Operations).

In general, we strongly recommend hiring a head of finance or CFO roughly six months prior to when you think you need one. It takes time to understand a new business, revamp processes, and develop KPIs so you’ll do well to factor some lead time. Convincing the current team that they will learn from a seasoned head of finance / CFO is also critical to a smooth transition.

______________

The “What”:

In our experience, founders are often unclear about the difference between Level 1 and Level 2. As a result, they either over-hire too early or – more often – fail to upgrade to more senior leadership as the business needs it. The latter mistake is often due to murkiness around the strategic value delivered by a level 2 finance leader, and what separates them from a level 1 finance leader. Here’s one way to think about it:

Level 1 Finance Function: the table stakes

- Description: mostly blocking and tackling which can be handled by a fractional or mid-level hire

- Responsibilities

- Bookkeeping and tax (including supervision of related parties)

- Basic cash mgmt. (AR, AP, runway analysis)

- Financial modeling level 1 (input taker)

- Budgeting level 1 (project mgmt.)

- Housekeeping (legal/financial doc organization, upkeep)

- Audit process management (if fairly basic)

- Basic Human Capital (payroll, etc.)

- Assist in board presentations and logistics

Level 2 Finance Function: the strategic value of a true senior financial leader

- Description: a true business partner capable of driving financial planning and analysis into every area of your business with the confidence to guide other senior leaders (including pushing back as appropriate)

- Bring data, fact-based opinions, and relevant experience to key decisions

- Proactively identify and prioritize opportunities to improve growth, margins, cashflow

- Proactively flag key business risks

- Able to distinguish between A and B players, help attract and land the former while developing the later

- Responsibilities (partial list)

- Develop top-level company KPI dashboard in collaboration with leadership

- Help identify most important KPIs and why (this is a true skill, one KPI dashboard does not fit all). Often there are a handful of KPIs for board level review, and additional ones that management monitors closely.

- Lead budgeting – level 2

- Take broad direction from CEO/Board and translate into detailed budget (iterative)

- Interface and drive healthy tension with each department to find balance of spend/benefit

- Enhance financial metrics and modeling – level 2 (true FP&A)

- Suggest most appropriate inputs and advise on reasonable assumptions based on historical data

- Be a strategic sounding board on spend allocation / burn management, flex test with various scenarios

- Illuminate how external parties (e.g., future investors) will look at it

- Manage investor relations

- Build, manage and help present board updates/materials (e.g., quarterly board deck, ad hoc situation briefs)

- Communicate with all investors (typically collaboratively with CEO)

- Manage ongoing relationships with banks and lenders

- Implement strategic process improvements

- Maintain and enhance technology stack as needed (accounting software, revenue recognition, cap table mgmt., etc.)

- Optimize working capital (AR/AP processes)

- Streamline HR process (payroll, benefits, etc.); the CFO often oversees the human capital function

- Spearhead debt/equity fundraising and M&A

- Advise on optimal timing, amount, and structure

- Materials prep including optimizing presentation / packaging of data

- Manage the process including appropriate staging

- Keep current on what’s “market” relative to valuation and key terms

- M&A may be less relevant unless ~20M+ ARR or if explicitly running acquisition strategy

- Other potential areas:

- Compensation design: spearhead / work closely with People Ops on benchmarking, comp design incl stock option plan, etc.

- Pricing strategy: pricing matrix, subscription vs. usage, discounting strategy, etc.

- Major commercial contracts: deal structuring, negotiation, and contract reviews for financial impact and risk. This encompasses key vendors, major customer deals including renewals, channel partnerships, etc.

- Develop top-level company KPI dashboard in collaboration with leadership

The “CFOO”: combining finance and ops

In some cases, fast growing startups might have a visionary CEO, but lack the detail-oriented executive that can help drive execution across functional areas. In this case, it’s sometimes possible to combine financial and operations leadership into one (often referred to as CFOO) to ensure the business has an ‘integrator’ to optimize execution. We only advise this when the individual actually brings relevant senior experience in both finance and operations. If they lack one or the other, you will likely create more problems than you solve.